Resources

Are you PCI DSS Compliant?

PCI DSS (Payment Card Industry Data Security Standard) is a set of requirements designed to ensure all businesses, regardless of size, that handle credit card information maintain a secure environment. It was created by the five major card schemes; American Express, JCB, Visa, MasterCard and Discover Financial Services to prevent and reduce card data fraud.

Being compliant with PCI DSS means that a business is doing their very best to keep their customers valuable information safe and secure and out of the hands of people who could use that data in a fraudulent way. Not holding on to data reduces the risk that customers will be affected by fraud.

Any merchant with a merchant ID that accepts payment cards must follow PCI-compliance regulations to protect themselves against data breaches. The requirements range from establishing data security policies for their business and employees to removing card data from their processing system and payment terminals.

PCI Compliance is separated into 4 levels, which level you fall into depends on the amount of processed transactions per year. Level 1 is for merchants that process the highest amount per year, and level 4 is for merchants that process the smallest amount.

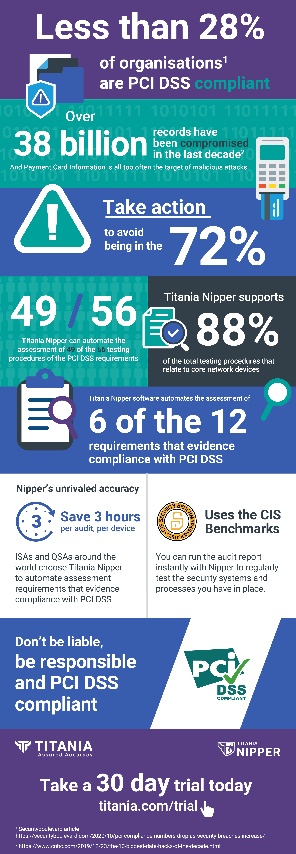

By using the Titania software, ISA and QSAs can choose to automate their most crucial PCI DSS Checks to get accurate views of their compliance. Nipper can save you 3 hours per audit, per device. The audit report can be run instantly to help you regularly test the systems and processes that you have in place.

Click on the image below to download the infographic on PCI DSS compliance or register for your 30 day free Nipper trial.